The Heaviest Credit Cards List (2026.2 Update: Bilt Palladium 21g)

Credit Cards Comparison

2026.2 Update: The new card Bilt Palladium is 21g in weight.

2025.7 Update: The new card Citi Strata Elite is 19g in weight.

Most credit cards are made of plastic of approximately 5 grams (g) of plastic, but some are made of metal.Not all metal cards have the same weight, which begs the question… which card is heaviest?

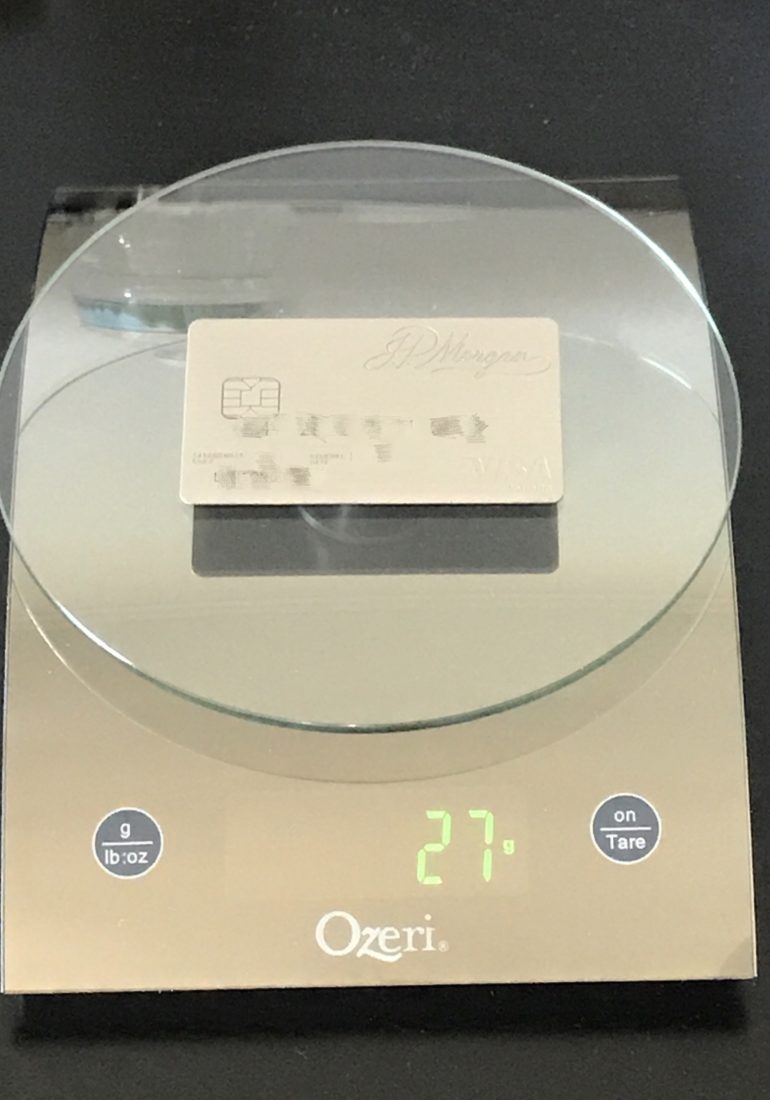

Annual fee: $450.You need to be a client of JP Morgan Private Bank in order to be eligible for this card (requires $10M investable assets).

Annual fee: $995

Annual fee: $495.

Annual fee: $595.

Annual fee: $495.HT: reader Ray.

Annual fee: $450

Annual fee: $5,000.

You have to be invited to apply for this card, there is no public application link.HT: reader erikfeifei.

Annual fee: $550

Annual fee: $395.You need to have a HSBC Premier account in order to be eligible for this card.HT: reader Michael.

Annual fee: $395

Annual fee: $95

Annual fee: $0

Annual fee: $400

Annual fee: $0.

Annual fee: $400

Annuel fee: $95

Annual fee: $0

Annual fee: $250

Annual fee: $450

Annual fee: $250

Annual fee: $95

Annual fee: $0

Annual fee: $450

Annual fee: $95

Annual fee: $0

Annual fee: $550

Annual fee: $450

Annual fee: $0

Annual fee: $95.

HT: Erik.

Annual fee: $0

Usual Plastic cards: 5g

Appendix: Discontinued Cards

Annual fee: $450

Note: After Chase Ritz-Carlton stopped taking new applications in 2018.7 (you can still product change to this card), the material seems to have been replaced with less heavy metal.

New card (12g):

Old card (28g):

Annual fee: $0 (note that you need to be a Robinhood Gold member to get this card which costs $5/month).Note: this real 10K gold version is a limited time edition, and you have to refer 10 friends to get it, which is very difficult.This promo has already expired.The photo below shows 37g, but the official website says it is 36g.

The difference is measurement error.

If you like this post, don't forget to give it a 5 star rating!

Publisher: Source link