Sep 20, 2025

![[Targeted] Wells Fargo Offers: 25%-50% Cash Back On Entertainment Purchase, Up To $100 Back (What Works)](https://www.mycardopinions.com/wp-content/uploads/2025/09/Targeted-Wells-Fargo-Offers-25-50-Cash-Back-On-Entertainment-Purchase.png)

[Targeted] Wells Fargo Offers: 25%-50% Cash Back On Entertainment Purchase, Up To $100 Back (What Works)

Update 9/19/25: Reminder to use this credit before it ends tomorrow. Update 8/29/25: Reposting to reflect some people getting 25% instead of 50% and also a list of what has triggered the credit for readers. Add your own datapoints below The Offer No direct link to offer, found under Wells Fargo offers Wells Fargo is offering 50% cash back on your…

Read moreSep 19, 2025

How Changing Interest Rates Impact Your Personal Finances

Key Insights Interest rates directly affect borrowing, saving, and investing decisions. Higher rates make loans more expensive but reward savers. Mortgage payments, credit card debt, and access to credit can shift quickly. Staying informed and adjusting your strategy helps protect your financial health. American Consumer Credit Counseling (ACCC) can guide you with personalized debt management strategies. What Are Interest Rates?…

Read moreSep 18, 2025

Apple AirPods Pro (2nd Gen) + 2-Year AppleCare+ For $149.99

The Offer Direct link to offer Costco has Apple AirPods Pro Wirless Earbuds w/ USB-C MagSafe Case (2nd Gen) + 2-Year AppleCare+ For $149.99 Our Verdict Keep in mind 3rd gen is coming out tomorrow. Still a good deal on the 2nd gen. Suspect this will probably sell out. Disclaimer: This story is auto-aggregated by a computer program and has…

Read moreSep 18, 2025

What A Federal Reserve Rate Cut Could Mean For Consumers

When the Federal Reserve cuts interest rates even by just 0.25%, it will have a direct impact on your finances. While a quarter of a percent may sound small, even slight changes in rates can ripple through the economy affecting everything from credit card payments to mortgage rates (more on that later). So why is Jerome Powell, as Chair of…

Read moreSep 17, 2025

Chase Sapphire Reserve Enhances $500 ‘The Edit’ Credit + Adds One-Time $250 Hotel Credit

The Chase Sapphire Reserve and Sapphire Reserve for Business cards both come with $500 in ‘The Edit’ credits for prepaid bookings of two nights or more on hotels/resorts found on The Edit platform. The credit is broken up into two $250 credits – you can’t get the full $500 on one booking. 2026 The Edit Enhancement Currently (9/17/25), the credit…

Read moreSep 16, 2025

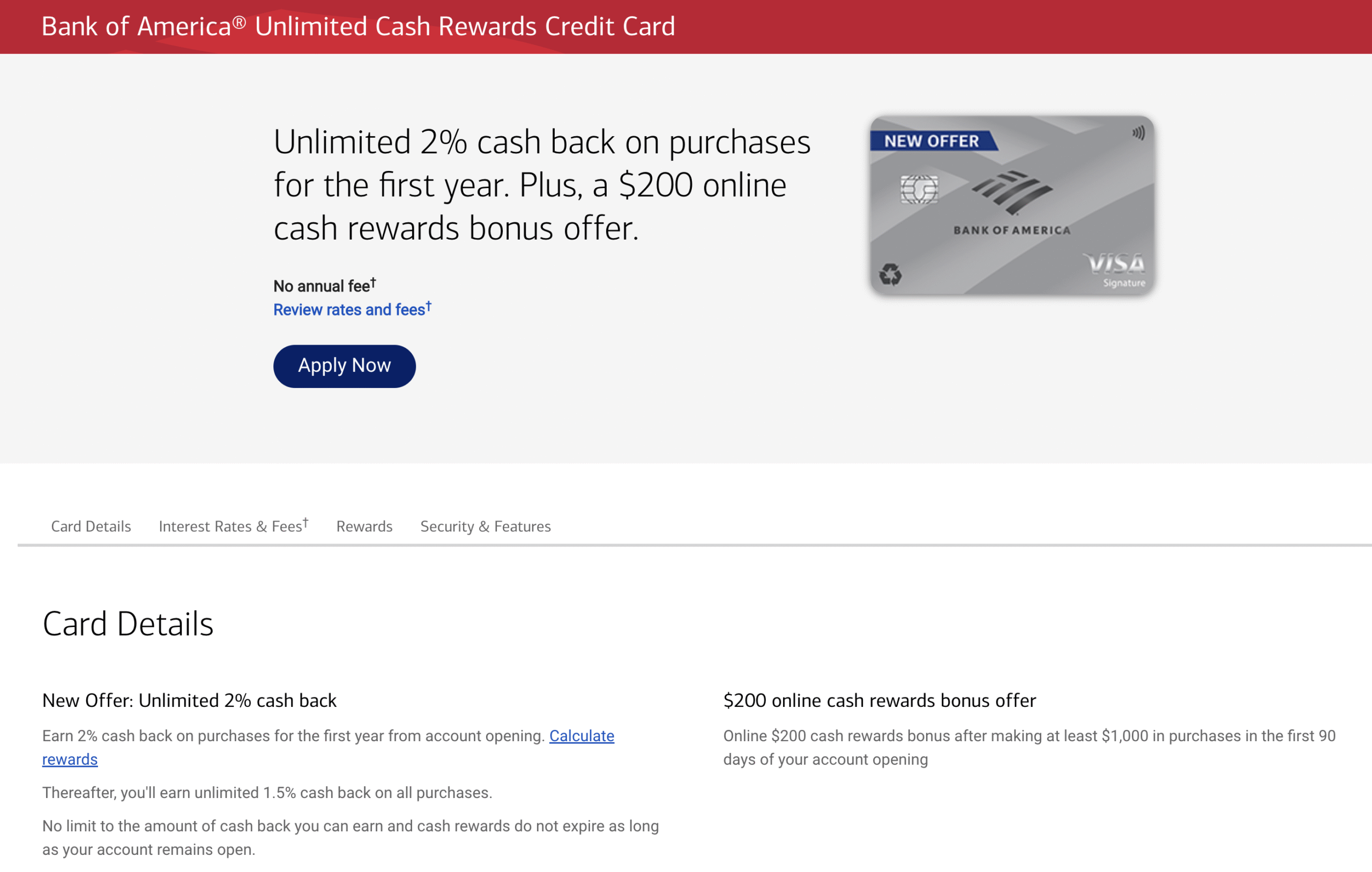

Bank of America Unlimited Cash Rewards Card: $200 Signup Bonus + 2%/3.12% Cashback During First Year

The Offer Direct Link to offer Bank of America added a new component to the signup bonus on the Unlimited Cash Rewards card: New Offer: Unlimited 2% cash back – Earn 2% cash back on purchases for the first year from account opening. Thereafter, you’ll earn unlimited 1.5% cash back on all purchases. No limit to the amount of cash back…

Read moreSep 15, 2025

How Changing Interest Rates Impact Your Personal Finances

Key Insights Interest rates directly affect borrowing, saving, and investing decisions. Higher rates make loans more expensive but reward savers. Mortgage payments, credit card debt, and access to credit can shift quickly. Staying informed and adjusting your strategy helps protect your financial health. American Consumer Credit Counseling (ACCC) can guide you with personalized debt management strategies. What Are Interest Rates?…

Read moreSep 15, 2025

![[Leaked] American Express Business Platinum Refresh Details](https://www.mycardopinions.com/wp-content/uploads/2025/09/Leaked-American-Express-Business-Platinum-Refresh-Details.png)

[Leaked] American Express Business Platinum Refresh Details

Details regarding the new American Express Business Platinum have been leaked. None of this information has been confirmed by American Express, but it looks legitimate. Here is what we know: $895 annual fee 200,000 Membership Rewards after $20,000 in spend within the first 3 months Choice between regular and mirror finish card $600 hotel credit ($300 semi annual credit for…

Read moreSep 14, 2025

Topcashback: 130% Back On PureVPN

Update 9/13/25: Available again. Looks like a $21+ moneymaker given the $71 charge I’m seeing. (If you can find a way to remove the coupon code it should bring the moneymaker up to $33.) The Offer Direct Link to offer Topcashback is offering 130% cashback on new customers to PureVPN. Our Verdict You can buy a 27-month plan for $53.95…

Read more